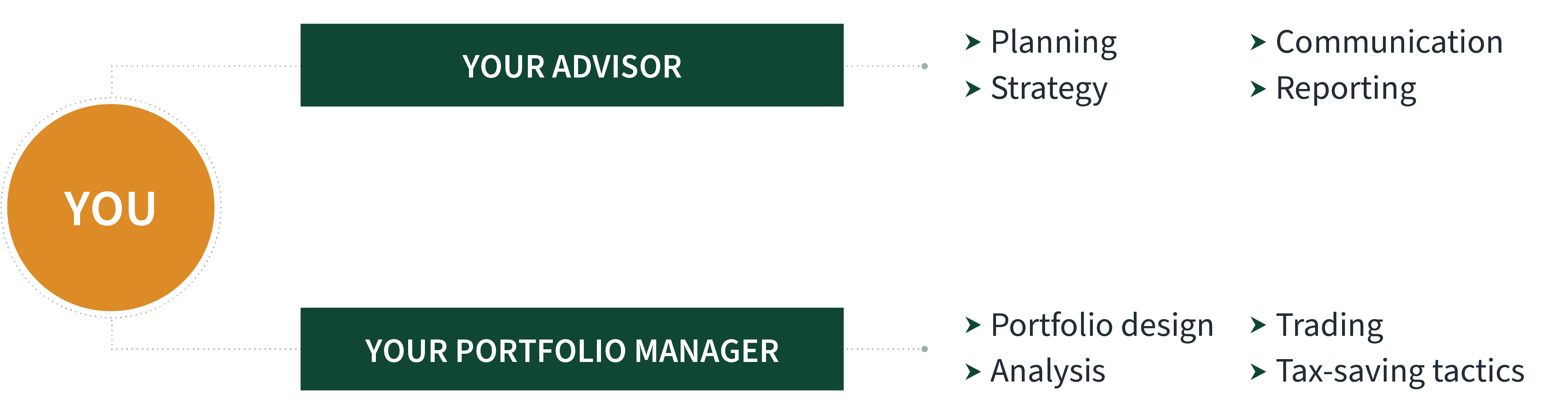

The Relationship

As a client in the Zacks Custom Asset Management program, you maintain your primary advisory relationship and your advisor continues to serve you.

The difference is that you and your advisor are paired with a portfolio manager from Zacks Investment Committee, who takes on the task of designing and managing a custom investment strategy for you.

What results is a best-of-both-worlds scenario where your advisor can focus on your life-centered financial picture, while your portfolio manager optimizes your investments to align with it.